Home Office Deduction Limit . home office deduction at a glance. Employees aren’t eligible for the tax break. If you use part of your home exclusively and regularly for conducting. what is the home office deduction? Here are the basics of this. based on your income and expenses, the government could limit how much you can deduct for your home office. the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. here's what you should know about the home office tax deduction before you file your 2023 tax return. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of.

from www.coverrossiter.com

If you use part of your home exclusively and regularly for conducting. home office deduction at a glance. here's what you should know about the home office tax deduction before you file your 2023 tax return. based on your income and expenses, the government could limit how much you can deduct for your home office. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Here are the basics of this. Employees aren’t eligible for the tax break. what is the home office deduction? the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income.

Understanding and Applying the Home Office Deduction Cover & Rossiter

Home Office Deduction Limit Employees aren’t eligible for the tax break. home office deduction at a glance. Employees aren’t eligible for the tax break. based on your income and expenses, the government could limit how much you can deduct for your home office. If you use part of your home exclusively and regularly for conducting. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. what is the home office deduction? the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. Here are the basics of this. here's what you should know about the home office tax deduction before you file your 2023 tax return.

From www.coverrossiter.com

Understanding and Applying the Home Office Deduction Cover & Rossiter Home Office Deduction Limit here's what you should know about the home office tax deduction before you file your 2023 tax return. Here are the basics of this. based on your income and expenses, the government could limit how much you can deduct for your home office. what is the home office deduction? If you use part of your home exclusively. Home Office Deduction Limit.

From flyfin.tax

What's New For Home Office Tax Deduction in 2023? FlyFin A.I. Home Office Deduction Limit your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Employees aren’t eligible for the tax break. here's what you should know about the home office tax deduction before you file your 2023 tax return. the maximum amount you can claim using the simplified method is $1,500. Home Office Deduction Limit.

From www.template.net

Home Office Deduction Template in Excel, Google Sheets Download Home Office Deduction Limit your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Employees aren’t eligible for the tax break. based on your income and expenses, the government could limit how much you can deduct for your home office. what is the home office deduction? home office deduction at. Home Office Deduction Limit.

From www.autonomous.ai

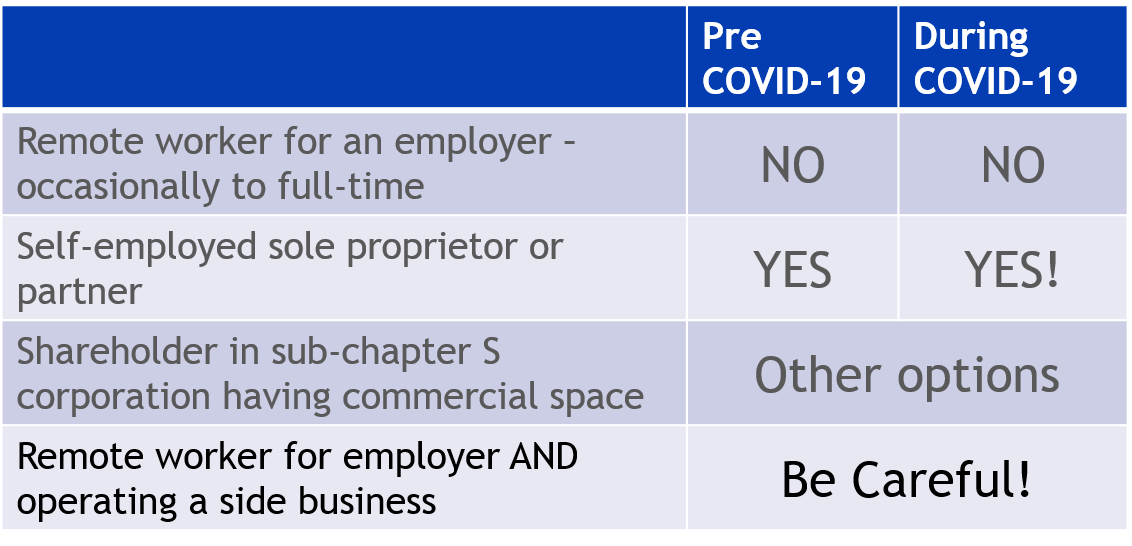

Home Office Deduction During Covid 2024 Update Home Office Deduction Limit Employees aren’t eligible for the tax break. If you use part of your home exclusively and regularly for conducting. home office deduction at a glance. what is the home office deduction? the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. here's what you should. Home Office Deduction Limit.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Deduction Limit home office deduction at a glance. If you use part of your home exclusively and regularly for conducting. based on your income and expenses, the government could limit how much you can deduct for your home office. Employees aren’t eligible for the tax break. here's what you should know about the home office tax deduction before you. Home Office Deduction Limit.

From www.superfastcpa.com

What is the Home Office Deduction? Home Office Deduction Limit here's what you should know about the home office tax deduction before you file your 2023 tax return. what is the home office deduction? the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. based on your income and expenses, the government could limit how. Home Office Deduction Limit.

From cjdfintech.com

Maximize Your Savings Unraveling the Benefits of the Home Office Tax Home Office Deduction Limit Employees aren’t eligible for the tax break. based on your income and expenses, the government could limit how much you can deduct for your home office. the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. what is the home office deduction? here's what you. Home Office Deduction Limit.

From www.financestrategists.com

Tax Deductions Definition, Types, Limits, Benefits, & Strategies Home Office Deduction Limit If you use part of your home exclusively and regularly for conducting. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. what is the home office deduction? here's what you should know about the home office tax deduction before you file your 2023 tax return. . Home Office Deduction Limit.

From www.ramseysolutions.com

Working From Home? Home Office Tax Deduction Ramsey Home Office Deduction Limit what is the home office deduction? your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Here are the basics of this. here's what you should know about the home office tax deduction before you file your 2023 tax return. the maximum amount you can claim. Home Office Deduction Limit.

From www.iota-finance.com

Saving on taxes using the home office deduction Home Office Deduction Limit Here are the basics of this. here's what you should know about the home office tax deduction before you file your 2023 tax return. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. If you use part of your home exclusively and regularly for conducting. Employees aren’t. Home Office Deduction Limit.

From www.lessaccounting.com

Home Office Tax Deduction Explained Home Office Deduction Limit based on your income and expenses, the government could limit how much you can deduct for your home office. the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. what is the home office deduction? Employees aren’t eligible for the tax break. your deduction for. Home Office Deduction Limit.

From www.homeofficedesktips.com

Important IRS Deductions For Home Office Home Office Deduction Limit Here are the basics of this. based on your income and expenses, the government could limit how much you can deduct for your home office. what is the home office deduction? If you use part of your home exclusively and regularly for conducting. Employees aren’t eligible for the tax break. here's what you should know about the. Home Office Deduction Limit.

From turbotax.intuit.com

The Home Office Deduction TurboTax Tax Tips & Videos Home Office Deduction Limit Here are the basics of this. based on your income and expenses, the government could limit how much you can deduct for your home office. here's what you should know about the home office tax deduction before you file your 2023 tax return. home office deduction at a glance. Employees aren’t eligible for the tax break. . Home Office Deduction Limit.

From www.taxdefensenetwork.com

An Easy Guide to The Home Office Deduction Home Office Deduction Limit Here are the basics of this. here's what you should know about the home office tax deduction before you file your 2023 tax return. home office deduction at a glance. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Employees aren’t eligible for the tax break.. Home Office Deduction Limit.

From www.stkittsvilla.com

Can You Take A Home Office Tax Deduction Virblife Com Home Office Deduction Limit home office deduction at a glance. here's what you should know about the home office tax deduction before you file your 2023 tax return. If you use part of your home exclusively and regularly for conducting. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. . Home Office Deduction Limit.

From fmtrust.bank

How to Calculate Home Office Deductions F&M Trust Home Office Deduction Limit home office deduction at a glance. Here are the basics of this. here's what you should know about the home office tax deduction before you file your 2023 tax return. the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. based on your income and. Home Office Deduction Limit.

From www.taxuni.com

Home Office Deduction Calculator 2024 Home Office Deduction Limit based on your income and expenses, the government could limit how much you can deduct for your home office. Employees aren’t eligible for the tax break. what is the home office deduction? here's what you should know about the home office tax deduction before you file your 2023 tax return. If you use part of your home. Home Office Deduction Limit.

From www.thebalancemoney.com

Basics of the Home Office Deduction Limit Home Office Deduction Limit the maximum amount you can claim using the simplified method is $1,500 (300 square feet), which can reduce your taxable income. Here are the basics of this. your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of. Employees aren’t eligible for the tax break. If you use part. Home Office Deduction Limit.